- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

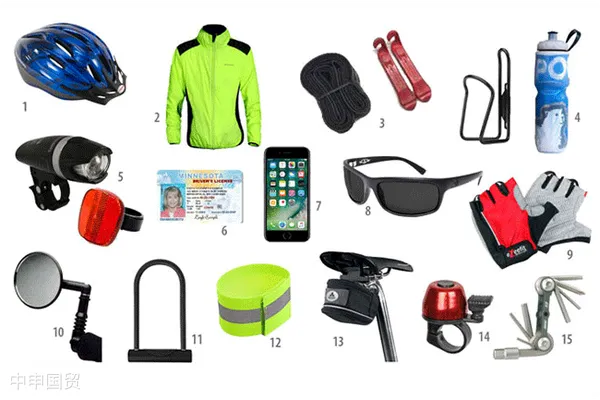

Cycling, as an environmentally friendly and healthy mode of transportation, is increasingly favored by people. On the cycling journey, professional equipment is undoubtedly every cyclists reliable assistant. From safety helmets to precise GPS navigation computers, the circulation of these equipment in the international market not only promotes the spread of cycling culture but also brings a series of customs declaration issues. This article will explore the classification of these cycling equipment duringimport and exportthe classification process.

Classification of Helmets

Helmets, as protective equipment, can disperse and absorb impact forces, ensuring the safety of cyclists heads. With the popularity of cycling, the market demand for helmets has gradually increased, and so has the need for their import and export customs clearance.

Basis for classification: According to the text of Heading 65.06 in the [Customs Tariff], cycling helmets fall under other safety helmets, with the commodity code 6506.1000.

Classification of Sunglasses

Sunglasses not only protect against UV rays and glare but also provide some degree of eye protection. As part of cycling equipment, cycling sunglasses have stable market demand, especially in summer.

Basis for classification: According to the text of Heading 90.04 in the [Customs Tariff], sunglasses fall under sun goggles, with the commodity code 9004.1000.

Classification of Other Equipment

Classification of Water Bottle Cages: Water bottle cages are specifically designed for bicycles. According to the notes of Section XVII in the [Customs Tariff], the commodity code is 8714.9900.

Classification of GPS Navigation Computers: GPS navigation computers fall under other radio navigation equipment. According to the text of Heading 85.26 in the [Customs Tariff], they should be classified under 8526.9190.

Classification of Cycling LED Lights: Cycling LED lights fall under lighting or visual signaling devices for bicycles. According to the text of Heading 85.12 in the [Customs Tariff], the commodity code is 8512.1000.

Accurately mastering the classification knowledge of various goods will help enterprises involved in import and export to pre-classify their products. This ensures correct declaration and classification of cycling equipment during customs clearance, facilitating smooth customs procedures. Welcome to contact our company for business inquiries. Consultation hotline: 139-1787-2118.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912