- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

For many companies, export business is no simple task. Throughout the export process, every detail on the customs declaration form requires careful attention, with transaction method being particularly critical. But what exactly is the relationship between this transaction method and the trade terms we commonly refer to? Today, we will delve into this topic.

Transaction method: What is it?

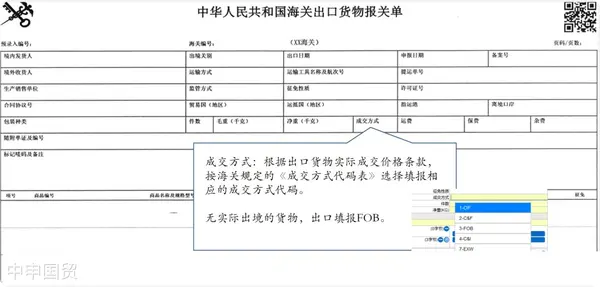

When you receive a customs declaration form, you will notice a specific column labeled transaction method. This transaction method is filled out based on the trade terms agreed upon in your export contract. However, it is important to note that while it is derived from trade terms, the two are not identical.

According to customs regulations, there are five primary transaction methods on the declaration form, but in practice, we typically encounter only four: CIF, C&F, FOB, and EXW.

Trade terms and transaction methods

Some might wonder: Arent CIF, FOB, etc., all trade terms? Why are they referred to as transaction methods here?

In fact, there are far more trade terms than transaction methods. For example, the Incoterms 2010 includes 11 trade terms. However, to simplify statistics and operations, customs have streamlined these trade terms into five transaction methods. For instance, if the trade term in the contract is FCA, you should fill in FOB as the transaction method on the declaration form.

The practical significance of trade terms

In simple terms, trade terms can be seen as the language of international trade. They clearly define the delivery location of goods, who pays for freight and insurance, and when the risk transfers from the seller to the buyer. Through these abbreviated letters, trading parties worldwide can understand the composition of the goods price, as well as the respective costs, risks, and responsibilities each party bears, without needing to describe every detail in the contract.

List of Parties Responsible for Costs between Buyers and Sellers under Various Trade Terms

How to calculate FOB price?

In theExport DrawbackIn daily work, the most critical aspect is calculating the FOB price. Even if the transaction method on your declaration form is not FOB, you need to know how to convert it to FOB price. The specific conversion method is as follows:

FOB=CIF?Freight?Insurance

Here, C stands for COST, I for INSURANCE, and F for FREIGHT.

Whether you are a beginner or a seasoned professional, a deep understanding and mastery of customs declaration forms, transaction methods, and trade terms in export business are essential. This ensures that everything proceeds correctly, whether when signing contracts with clients or handling actual customs procedures, avoiding unnecessary complications and losses.

ZhongShen International TradeAs a one - stop importExport Representationservice provider, it can provide customizedimport and exportSolution. If you needforeign tradeFor import and export agency services, please feel free to contact our company for business inquiries. The consultation hotline is 139 - 1787 - 2118.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912