- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

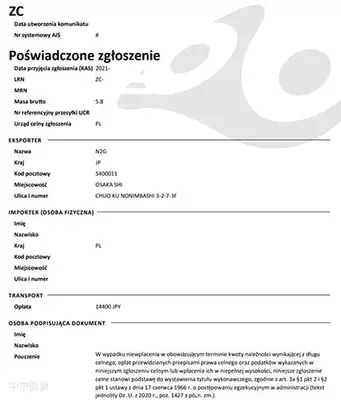

PZC [Po?wiadczenie Zg?oszenia Celnego] is a Polish Customs document, namely the Customs Declaration Certificate. According to Value Added Tax (VAT) regulations, it is a Customs document that authorizes the holder to deduct input tax. This certificate is typically included in the tax declaration for the period when the relevant Customs documents are received.

Steps to Obtain a PZC Document:

Customs Declaration:

When goods arrive in Poland and undergo Customs declaration, the process must be handled by an authorized Customs broker or trading company. During declaration, the relevant information will be entered into the Polish Customs system.

Generate PZC file:

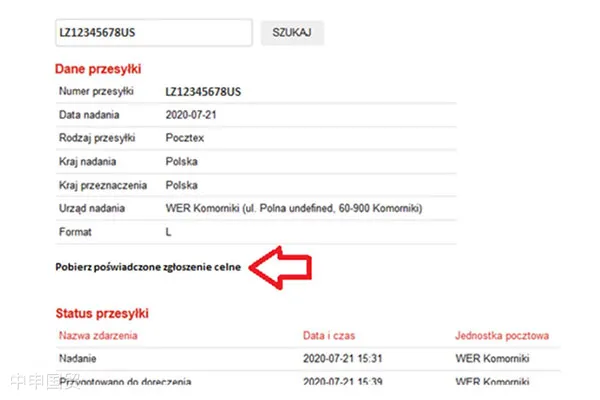

Once the Customs declaration is completed and accepted by Customs, the PZC document will be generated. This document can usually be downloaded from the Polish Customs online system.

Download the Document:

The taxpayer needs to download the corresponding document from the Customs authoritys server. The time of download is considered the moment of document receipt, which is critical for VAT declaration and tax deduction.

Tax Processing:

With the PZC document, businesses can declare and deduct input tax related to the declared goods in their VAT returns.

Precautions:

(1) Keep Information Updated:Ensure all information used during the declaration process is accurate to avoid potential delays or Customs penalties.

(2) Professional Assistance:Given the potential complexity of Customs and tax regulations, especially in international trade, it is advisable to work with professional Customs and tax consultants to ensure all procedures comply with Polish laws and regulations.

The PZC document not only helps ensure Customs compliance but is also crucial for a companys financial and tax management, particularly when handling VAT refunds. If in doubt, promptly consult a Polish Customs broker or tax expert for the most accurate guidance and support.

Related Recommendations

Learn

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912